- News

- Business News

- International Business News

- Best over for US stocks? Jefferies’ Chris Wood makes big prediction, says investors should look at India, China

Trending

Best over for US stocks? Jefferies’ Chris Wood makes big prediction, says investors should look at India, China

Jefferies' Christopher Wood predicts a decline in US stocks, Treasury bonds, and the dollar, suggesting the US market has peaked, similar to Japan in 1989. He advises investors to rebalance portfolios by adding Chinese, Indian, and European assets.

Are the best days over for US stock markets? The US equity market has surpassed its peak performance period, and investors need to be ready for additional dips in stocks, Treasury bonds and the US currency, warns Christopher Wood from Jefferies Financial Group Inc.

According to Wood, who serves as the firm's global head of equity strategy, US equities' market value as a proportion of the MSCI All Country World Index hit its highest point in late December. "The US has made an all-time peak," he said, likening it to the Japanese market in 1989. "The dollar has begun a long-term weakening trend, and that's going to reduce the US stock market capitalization as percentage of the world."

According to a Bloomberg report, Wood suggests that investors should diversify their portfolios by incorporating assets from China, India and Europe.

The experienced strategist's negative outlook on US markets reflects growing worldwide skepticism about America's continued market dominance, particularly in light of President Donald Trump's disorganised implementation of tariff policies.

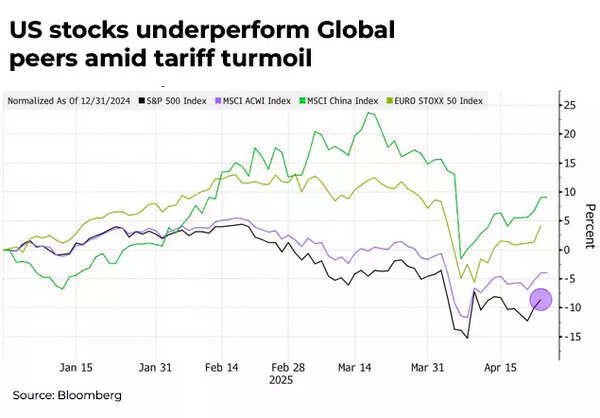

US stocks underperform global peers

US stocks represent approximately 60% to 70% of global market capitalisation, yet their economic contribution to worldwide wealth is not proportionally equivalent, he observed.

American equities have barely escaped entering a bear market, contrasting sharply with their previous record-breaking performance this year. The S&P 500 has recovered from its lowest point this month, however its 8.6% decline year-to-date remains behind European and Chinese market indicators.

Also Read | Gold prices hit Rs 1 lakh! What's the outlook for gold and should you buy or sell the yellow metal? Explained

"It's not just a question of the US going down. It's a question of Europe, China and India going up," he said.

The majority of international investors lack investment presence in India, Wood stated. "I'm saying they should. Any global emerging market investors tend to own India. I'm saying global funds should own India too."

About the Author

TOI Business DeskEnd of Article

Follow Us On Social Media