- News

- City News

- surat News

- Study dissects biases of stock market investors

Trending

Study dissects biases of stock market investors

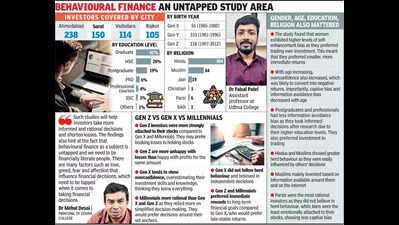

Surat: A study on the behaviour of stock market investors from Gujarat's cities has found that 52.39% of investors get emotionally attached to their stocks and don't sell them even after prices go down. The other findings: Women prefer trading to investment, resulting in smaller returns; Gen Z investors get more unhappy with losses than happy with profits of the same amount.

Dr Faisal Patel, an assistant professor at Udhna College here, studied 607 investors from four major cities of Gujarat — Ahmedabad, Surat, Vadodara and Rajkot over the past four years.

Patel's sample had 373 men and 234 women of various educational backgrounds, religions and ages. The study was part of his PhD, under the guidance of Udhna College principal Dr Mehul Desai.

On what prompted him to conduct the study, Dr Patel, who teaches commerce and accountancy, told TOI: "I thought of the subject during Covid as many people shifted to the stock market because of low interest rates on fixed deposits. Returns from other savings instruments also fell and people felt the stock market was more rewarding at the time. I thought I ought to examine the psychology and behaviour of these investors and went for it for my PhD."

Patel found many interesting aspects to investor behaviour. As part of captive bias, 52.39% of investors did not sell their stocks when their price went down, as they were emotionally attached to certain scrips. Some 48% held stocks even after negative news about them.

In self-enhancement bias, 59.14% suffered from overconfidence, believing they succeeded more than they failed when it came to investment. Around 52% believed they profited because they were experts on the share market, while 51% believed they could predict stock market trends perfectly.

The study also focused on rational decisions under the bounded rationality bias. Around 48% admitted they did not do research and invested based on information available. As many 51.89% relied on trends and news rather than fundamental analysis.

The most notable behaviour in the stock market is herd behaviour, which was also covered here. About 50% of subjects agreed that other investors' stock selections influenced their decisions. Some 53% would immediately buy stocks suggested by an advisor. About 47% believed a stock was secure if many others invested in it, and an equal number believed in friends who had helped them earn profits in the past.

As an indication of short-term focuses, as many as 54% of investors would frequently check the market value of their investments.

Investors also showed information avoidance bias on a large scale, as 48% believed easily available information was more reliable than alternative sources. Investors selectively focused on news supporting their beliefs, ignoring other viewpoints.

End of Article

FOLLOW US ON SOCIAL MEDIA