- News

- Technology News

- Tech News

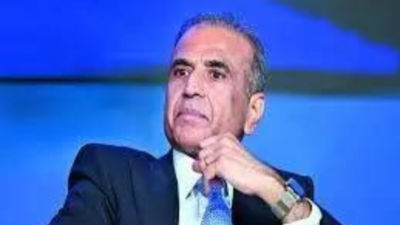

- Bharti Airtel chairman Sunil Mittal says with return on capital in telecom industry, “We may as well put the money in the bank and go ..."

Trending

Bharti Airtel chairman Sunil Mittal says with return on capital in telecom industry, “We may as well put the money in the bank and go ..."

Sunil Mittal, Bharti Airtel chairman, highlighted the unsustainable model of the global telecom industry. He urged for lower taxes and affordable spectrum allocation. European telecom leaders echoed these concerns, criticizing excessive regulation and suggesting that Europe emulate the US market structure, which has fewer operators, to enhance profitability and competitive advantage in the 5G era.

Bharti Airtel chairman Sunil Mittal lamented poor return on capital expenditure for the telecom industry world wide. Speaking on Day 1 at the Europe's biggest mobile industry annual tradeshow, Mittal said that the way the telecom industry functions globally is unsustainable. "We will [have] to reset our industry.”

Mittal urged telecom authorities worldwide to lower taxes and allocate sufficient spectrum at affordable rates. He said that while average industry revenue growth is just around 2%, year after year telecom companies have to face demands to buy expensive spectrum. This amounts to almost putting $200 billion into capex annually.

“This is one industry that is bearing the burden of building out the digital infrastructure across the globe. How much is this industry taking the load itself? The return on capital is just an average of 4 4%,” the Bharti Airtel chairman said. “We may as well put the money in the bank and go and play some golf,” Mittal added.

European Telco Bosses 'unhappy' with over-regulation

Della Valle said, “In this global race, Europe’s falling behind. In the 5G era, we’re trailing.” Many executives see mergers as the solution, but regulators across Europe have repeatedly thwarted or altered deals that would shrink the number of operators per market from four to three, prioritizing affordable consumer prices.

European telecom companies want EU to follow India, US and China

About the Author

TOI Tech DeskEnd of Article

Latest Mobiles

FOLLOW US ON SOCIAL MEDIA